top of page

Transform your bank data into a new revenue engine

Earn high-margin, non-interest income through merchant-funded rewards, powered by Reworth

Banks are becoming billion-dollar media platforms

65-85%

Gross margin for banks

As third-party cookies disappear, Financial Media Networks (FMNs) are emerging as the next major ad channel. Reworth enables banks to monetize their verified, first-party transaction data — connecting brands directly with consumers inside the banking app.

$27B

Addressable market by 2025

100%

Privacy-safe and cookie-free

New Revenue Streams Without Risk

Transform your existing customer data into a profitable new business line. Reworth enables banks to monetize purchase data while enhancing customer value.

Generate recurring revenue from merchant partnerships without operational overhead.

High-Margin SaaS Revenue

Earn a percentage of merchant advertising spend through performance-based campaigns.

Advertising Revenue Share

Increase card usage and customer retention through instant cashback rewards.

Enhanced Customer Loyalty

Privacy-First Architecture

Reworth is built on zero-knowledge principles, ensuring customer privacy while enabling performance attribution. We process transactions without accessing personal information.

All data transmission and storage uses bank-grade encryption standards.

End-to-End Encryption

.

Zero-Knowledge Processing

Regulatory Compliance

Full GDPR, PCI DSS, and local financial regulations compliance.

1. Connect

Reworth integrates securely with your transaction data

How It Works For Banks

Old Model

CPC/CPM pricing

Cookie-dependent tracking

Estimated conversion

Brand awareness focus

Reworth's Model

Par-per-verified-conversion

First-party transaction data

97% attribution accuracy

Direct sales impact

2. Show offers

Merchants fund cashback offers that appear natively inside your banking app.

3. Earn

Every verified purchase generates revenue for your bank — automatically.

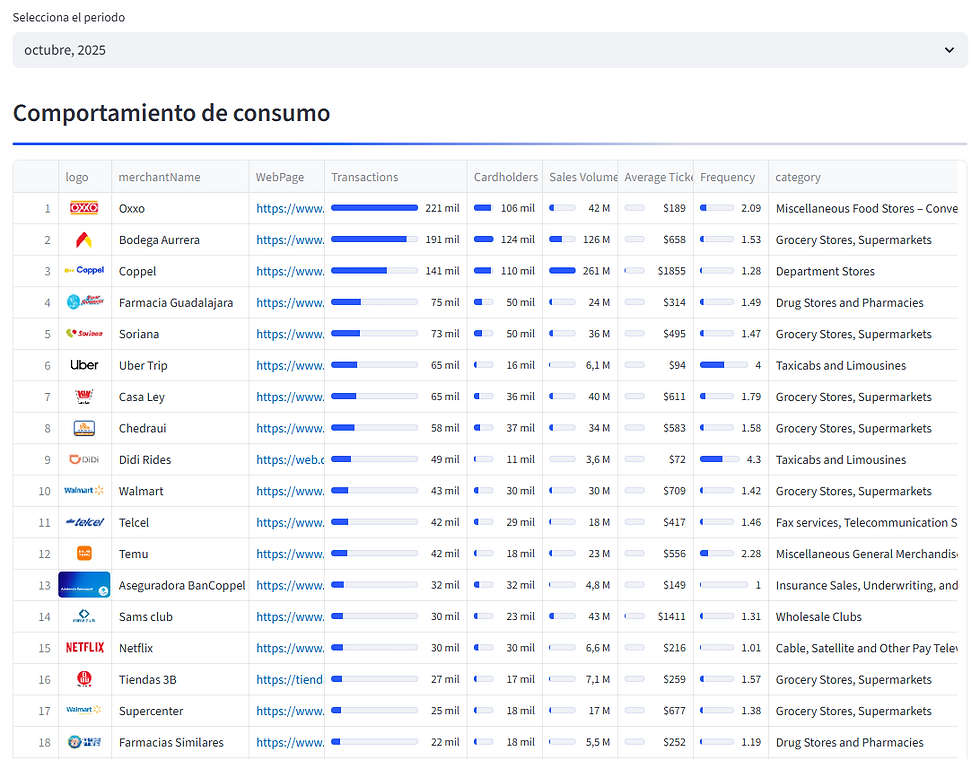

Data Enrichment From transactions to intelligence

Industry-leading precision in merchant identification

97%+ accurate transaction labeling

Instant insights dashboard for your transaction data

Real-time merchant categorization

Predictive analytics and segmentation

AI-powered customer behavior forecasting

Create strategies to activate or reactivate cardholders

151,560

Trusted by Industry Leaders

Reworth already powers Financial Media Networks for major institutions like BanCoppel, Liverpool, and Suburbia — reaching millions of cardholders monthly.

1B+

Transactions processed (real time)

100%

Bank retention

Ready to unlock a new revenue stream?

Join forward-thinking banks that are already monetizing their customer data with Reworth

Contact us:

Follow us:

Find us in: México, Argentina, Switzerland, United States and United Kingdom

bottom of page